Dive Brief:

- Nonresidential construction input costs finished 2025 up 3.2% year over year, largely due to tariff-related impacts. For overall construction, which include residential builds, costs gained 2.8%, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index figures.

- For December, construction input prices ticked down 0.6% month over month to end the year, while nonresidential costs were 0.7% lower. But those dips couldn’t offset the annual jump.

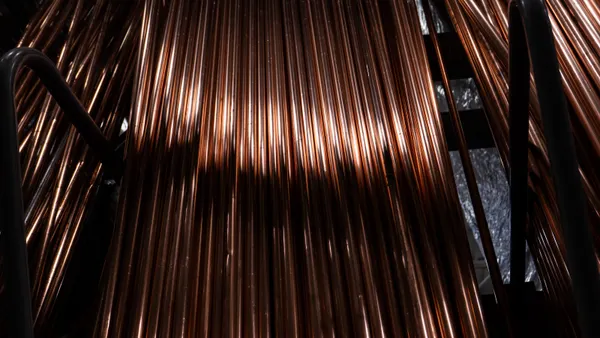

- Prices for materials most exposed to tariffs, including copper wire and cable, jumped 22% year over year, and seem poised to continue climbing in 2026 as “key inputs are still experiencing rapid escalation,” said Anirban Basu, ABC chief economist.

Dive Insight:

For commodities less exposed to tariffs, such as asphalt or crushed stone, the index should hover around the same level in the coming months, said Basu.

That’s likely due to overall soft demand for construction services outside of the booming data center sector.

But the expectation for more price jumps this year has not yet dimmed contractor optimism, said Basu. About seven in 10 ABC members expect profit margins to stay the same or grow over the next two quarters, he said.

Despite that upbeat note, tariff impacts on materials costs have begun to make their way into the data, and economists don’t think that will end soon, according to the Associated General Contractors of America.

“Even though these indexes are based on selling prices of domestic producers, it is clear that the steep tariffs on imported metals and products are enabling U.S. sellers to push up costs for construction materials and equipment,” said Ken Simonson, AGC chief economist. “Construction costs are sure to rise further in 2026 as long as the current tariffs remain in place.”

The producer price index for aluminum mill shapes surged 30.5% from December 2024 to December 2025, the largest year-over-year increase since the supply chain disruptions of early 2022. Simonson added the index has been accelerating every month since President Donald Trump imposed a 50% tariff on aluminum last June.

The index for steel mill products, which are also under a 50% tariff, jumped 17% for the full year 2025. That’s the steepest rise for the material since 2022, according to the AGC release.

“Those higher prices are now showing up as well in the cost of construction equipment and machinery,” said Simonson. “That index rose 5.6% in the latest 12 months, the most in two years.”

Simonson added the cost of copper will surely “go even higher this year if the tariffs stay in place.”