Dive Brief:

- Construction input prices increased 0.2% in August due to jumps in iron and steel costs, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data.

- The uptick means prices are now 2.3% higher for overall inputs and 2.6% higher for nonresidential construction compared to a year ago, according to the data.

- “The increase would have been larger if not for declining oil and natural gas prices,” said Anirban Basu, ABC chief economist. “Prices rose at an especially rapid pace in some of the categories most affected by tariffs.”

Dive Insight:

Impacts from tariff hikes keep fueling a high level of volatility across construction materials, according to the Associated General Contractors of America.

“There is a limit to how many price increases the market can absorb before owners put projects on hold,” said AGC CEO Jeffrey Shoaf. “The more the administration does to resolve trade disputes, provide more certainty and lower punitive tariff levels, the more demand for construction should rebound.”

Uncertainty has led to more project delays and outright cancellations, said Ken Simonson, AGC chief economist. About 43% of contractors reported at least one project in the past six months had been canceled, postponed or scaled back because of higher costs, according to an AGC-NCCER survey.

“The huge increases in steel and aluminum tariffs appears to have enabled domestic producers to push up their selling prices,” said Simonson. “These price increases are prompting some owners to rethink planned construction projects.”

Yet, compared to the double-digit increases of 2021 and 2022, the price jumps look relatively mild and are in line with projections for August, said Paul Giorgio, chief operating officer at Los Angeles-based Eldridge Acre Partners, which spun off from AECOM Capital as a separate investment real estate firm. Still, overall inputs to nonresidential construction sit close to 44% higher than February 2020, despite the essentially flat growth this month.

Two in five contractors reported a markup on their own prices to offset tariffs, and many other firms tried to get ahead of further hikes through earlier procurement, according to the AGC-NCCER survey. Another 16% of contractors reported they absorbed the higher cost themselves or negotiated cost-sharing with suppliers, according to the survey.

Nearly 40% of contractors expect materials prices to rise further in the coming months.

But those increases are not yet showing in the broader economy, said Giorgio.

“The construction market is driven by supply and demand, and the demand is much lower than the previous years, resulting in contractors and subcontractors especially being very competitive with their pricing to win work,” Giorgio told Construction Dive. “Moreover, the impacts of material tariffs have not materialized as seen in the latest CPI number, given the boost in domestic production and strategic alternative sourcing from subcontractors and suppliers.”

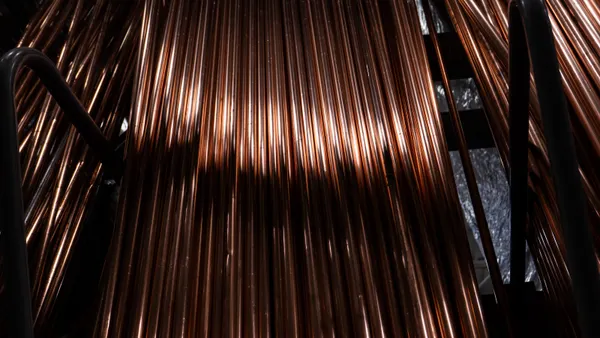

Iron and steel prices are already up 9.2% on a year-over-year basis. Copper wire and cable prices, critical components for the booming data center construction market, jumped 13.8% over the past 12 months. Switchgear, switchboard and industrial control equipment increased 10.5% over the same period, according to the data.

However, Basu noted “contractors remain broadly optimistic about their profit margins over the next six months.” AGC officials acknowledged the Trump administration has made progress in resolving some trade disputes, but said reaching agreements with China, Canada and Mexico remains critical.