Dive Brief:

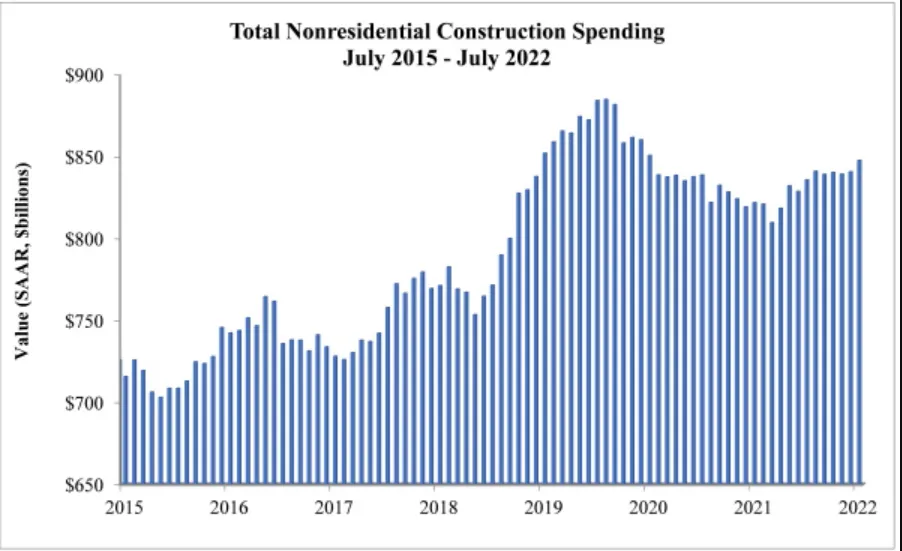

- Nonresidential construction spending ticked up by 0.8% in July, led by publicly funded projects in the highway and public safety categories, but prevailing headwinds will keep private sector development muted, according to an analysis of government spending data released by Associated Builders and Contractors.

- Spending on highways and streets was up 4.4% in July, and 4.6% from a year ago, while public safety gained 2.3% but was still down 4.7% over the previous 12 months, according to the U.S. Census Bureau. While 13 of the 16 nonresidential categories showed gains from last month, the water supply and healthcare categories were the biggest losers, shrinking 0.5% and 1.3%, respectively.

- Indeed, the boost in public construction spending helped keep the nonresidential sector in the black for the month, even though overall construction spending fell 0.4%, dragged down by a 1.5% slump in residential spending in July. Public nonresidential spending gained 1.5%, while private nonresidential spending eked out a 0.4% gain.

Dive Insight:

The overall amount of nonresidential spending, at a seasonally adjusted annual rate of $1.78 trillion, was still below its pre-pandemic levels, however. Against that backdrop, Anirban Basu, chief economist for ABC, said publicly financed construction was a bright spot for the industry.

“State and local governments are flush with cash, and considerable funding is slated for various forms of infrastructure,” Basu said in a statement. Indeed, sources say $1.2 trillion from last year’s infrastructure act is starting to hit government agencies. That money will be followed by additional construction funds from the recently passed $739 billion Inflation Reduction Act and $52 billion CHIPS Act.

Construction Spending, Millions of Dollars, Seasonally Adjusted Annual Rate, July 2022

| July 2022 | June 2022 | 1-month Change | |

|---|---|---|---|

| Total Construction | $1,777,296 | $1,784,299 | -0.4% |

| Residential | $929,667 | $943,612 | -1.5% |

| Nonresidential | $847,630 | $840,687 | 0.8% |

SOURCE: BLS, ABC

But while public spending is shaping up to be the life boat it was portrayed to be during legislative negotiations, private developers may have a harder path ahead, and overall spending could be impacted as well, Basu said.

“For privately financed construction, circumstances could get worse before they get better,” said Basu, highlighting the Federal Reserve’s commitment to raising interest rates further to fight inflation, continued supply chain snarls and the threat of a global recession. “This is simply not a set of circumstances conducive to rapid nonresidential construction spending growth,” he said.