Ferrovial has staked its reputation on construction projects that keep cities running.

The Amsterdam-headquartered civil engineering firm, which will help deliver New York’s $9.5 billion new Terminal One at JFK Airport, sees infrastructure as a durable sector. Silvia Ruiz, Ferrovial’s global head of investor relations, outlined how population growth and urbanization fueled demand for highways and airports in a prior conversation with Construction Dive.

Here, Ruiz shifts her focus to the mechanics of what makes those projects resilient in the face of tighter budgets and shifting economic conditions.

After more than two decades in infrastructure finance, she says “boring” assets such as toll roads and airports are anything but dull. In her view, these projects generate reliable returns, and perhaps more importantly, outlast economic cycles. Ruiz pointed to performance in the company’s highway division and progress on JFK’s new terminal as evidence of the sector’s strength.

Below, Ruiz talks with Construction Dive about the outlook for roads, airports and overall U.S. infrastructure construction.

The following has been edited for brevity and clarity.

CONSTRUCTION DIVE: Why are roads and airports resilient long-term investments?

SILVIA RUIZ: Roads, highways and airports are essential to help keep people and goods moving. Improving this infrastructure results in more efficient travel, especially for growing cities in need of mobility solutions. Infrastructure is a long-term, long-lived asset, attracting investors with longer holding periods. Owning a piece of toll road or airport assets offers stable and inflation-adjusted returns.

The results on roads and airports speak for themselves.

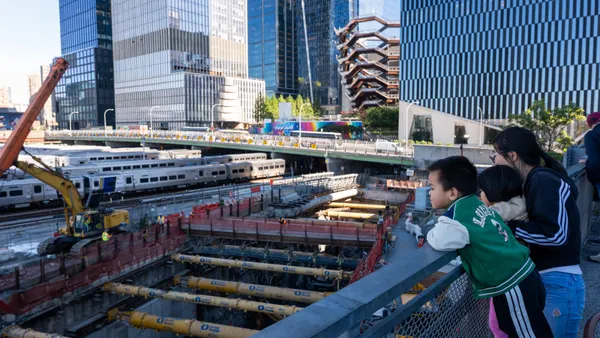

In the first half of 2025, Ferrovial’s Highways division delivered strong revenue from its North American assets, reporting a 14.9% increase. In airports, the New Terminal One at New York’s JFK Airport continues to progress and is set to open next year, with construction having advanced 72% by the end of the second quarter 2025.

As cities, communities and businesses grow across the U.S., the need for infrastructure projects and improvements increases. The necessity of infrastructure creates a steady demand.

How do city and municipal finance conditions influence the types of projects Ferrovial pursues?

Infrastructure funding is a pain point for most states and cities, and public-private partnerships offer an innovative solution. As cities grow and budgets tighten, the private sector can help close the funding gap, offering a more efficient way to deliver critical infrastructure to communities. We believe public-private partnerships will be the foundation of this new era of infrastructure development in the U.S.

One example is our managed express lanes in Dallas-Fort Worth. The TEXpress lanes, NTE, NTE 35W and LBJ Express, have resulted in significant economic impact, contributing approximately $24 billion into the local economy, supporting 115,000 jobs and providing nearly $7 billion in wages earned. We’ve successfully replicated this P3 managed lanes model in Virginia at the 66 Express outside the Beltway, and North Carolina at the I-77 Express.

We see an attractive pipeline of assets in cities where Ferrovial is already present, like Atlanta, Charlotte, Nashville and Northern Virginia, that have a clear need for infrastructure to enhance mobility.

How are tariffs and supply chain pressures on key materials influencing Ferrovial’s approach to airport and highway projects?

Many of Ferrovial’s large-scale construction projects are past early phases, so we see limited exposure. Additionally, we have a strong commitment to local sourcing, almost 97% of our purchases come from local providers every year.

We’ve been operating in the U.S. for 20 years, and the long-term need for modern, resilient infrastructure continues to grow. We see an attractive pipeline of assets that will deliver value to our stakeholders. Overall, our construction order book is healthy, reaching an all-time high, and the division is delivering solid profitability with an adjusted EBIT margin of 3.5%, in line with our long-term target. We’re excited to continue delivering infrastructure across the U.S.

Given higher borrowing costs in recent years, what trends are you seeing in the financing environment for major infrastructure builds?

There’s an estimated $3.7 trillion investment gap for U.S. infrastructure.

The U.S. Department of Transportation updated their Transportation Infrastructure Finance and Innovation Act program, or TIFIA, enabling a larger pool of sponsors to finance more of their projects. Raising the loan cap to 49% opens the door for more project sponsors, but successful delivery still depends on experience, scale and discipline.

Recent trends have been in favor of streamlining regulations and processes. These efforts accelerate project delivery, enhance safety and increase public-private partnership opportunities to bring essential infrastructure to communities.

Are you noticing any other trends around infrastructure construction?

Infrastructure continues to be a strong, durable asset class generating resilient revenue, strong margins, stability and inflation-resistant results. But what’s exciting now is how it’s evolving as cities grow and travel demand increases.

Airports, for example, are being designed as destinations themselves, becoming travel hubs with shopping, dining and hospitality that contribute to revenue. Highways and airports are becoming smarter through digital tools, from dynamic tolling systems that ease congestion to advanced passenger flow technologies that make travel more efficient.

These shifts demonstrate resilience in infrastructure assets, while also telling a growth story, as infrastructure remains a vital benefit for the U.S., creating impactful investment opportunities.

For Ferrovial, we delivered a strong performance in the first half of 2025, supported by solid revenue and growth from our unique North American assets. We see a deep pipeline of opportunities to deliver projects that help growing communities thrive and create lasting value for stakeholders.