Denis Bacon, general manager of Reston, Virginia-based Bechtel’s semiconductor segment, has lived in the Phoenix area nearly his entire life. If you ask him about the region’s construction environment, he’ll say the industry has always been strong.

While global tech giants like Intel have been around at its semiconductor manufacturing plant in Chandler, Arizona, for decades, more recent development has industry pros watching the Phoenix metro area for new data centers and semiconductor fabs.

Some large projects in the works include a $600 million Google data center in nearby Mesa, Arizona, and two semiconductor fabs worth $20 billion in Chandler.

One of the key drivers of expansion in the area is the weather, experts say. While the heat is not for the faint of heart (the area recorded 55 days over 110 degrees F this year), Phoenix and the surrounding region have few natural disaster risks from events such as earthquakes or tornadoes. That kind of stability is huge for the semiconductor industry, which is dependent on avoiding disruptions and delays.

“All these industries are targeting 100% uptime, certainly data centers and semiconductor manufacturers,” Bacon told Construction Dive. “These are big, complex facilities, and they can't afford to go down, certainly in an unprepared way.”

In addition to tech firms, Phoenix attracts other types of corporations looking to set down roots thanks to its low utility costs and a business-friendly environment that benefits from measures like former Gov. Doug Ducey’s regulatory sandboxes, which cut down on red tape businesses may face in some other states.

Key ingredients

The last seven years have been banner ones for the area, said Jennifer Mellor, the chief innovation officer at the Greater Phoenix Chamber of Commerce.

On top of large industrial projects like semiconductor fabs, Mellor pointed to the education and financial services sectors, which include Arizona State University, along with offices for Wells Fargo and JP Morgan Chase, as large drivers of growth. Mellor referred to the metro’s moniker as the “Wall Street of the West.”

Top construction projects in Phoenix

| Project | Contractors | Cost |

|---|---|---|

| Taiwan Semiconductor Manufacturing Co. semiconductor fabs | Dallas Commercial, CTCI Americas, Inc. (First fab) | $40 billion |

| Intel semiconductor fab 52/62 | Hoffman Construction, Jacobs Engineering | $20 billion |

| LG Energy Solution Battery Plant | Yates Construction | $5.5 billion |

| Virgin Industrial Park | Graycor Construction, Deutsch Architecture Group | $2 billion |

“The market remains strong but is shifting to different industries,” Mellor said.

However, this doesn’t mean that the area is free from worries. A recent report from Seattle-based cost consulting firm Cumming Group found that Phoenix’s construction market volume is forecasted to dip 13.4% this year, mostly dragged down by the residential sector.

Mellor said that the residential market will remain tight as long as interest rates are high. However, despite a predicted 21.8% decline in residential construction market volume predicted for 2023, per the Cumming Group report, work in other sectors is keeping commercial contractors busy, said Kevin Herron, Cumming senior vice president of cost management.

“There’s a huge amount of stability and growth that’s really coming from the CHIPS side,” Herron said, referring to the $52 billion in funding that came from the Chips & Science Act signed by President Joe Biden in 2022.

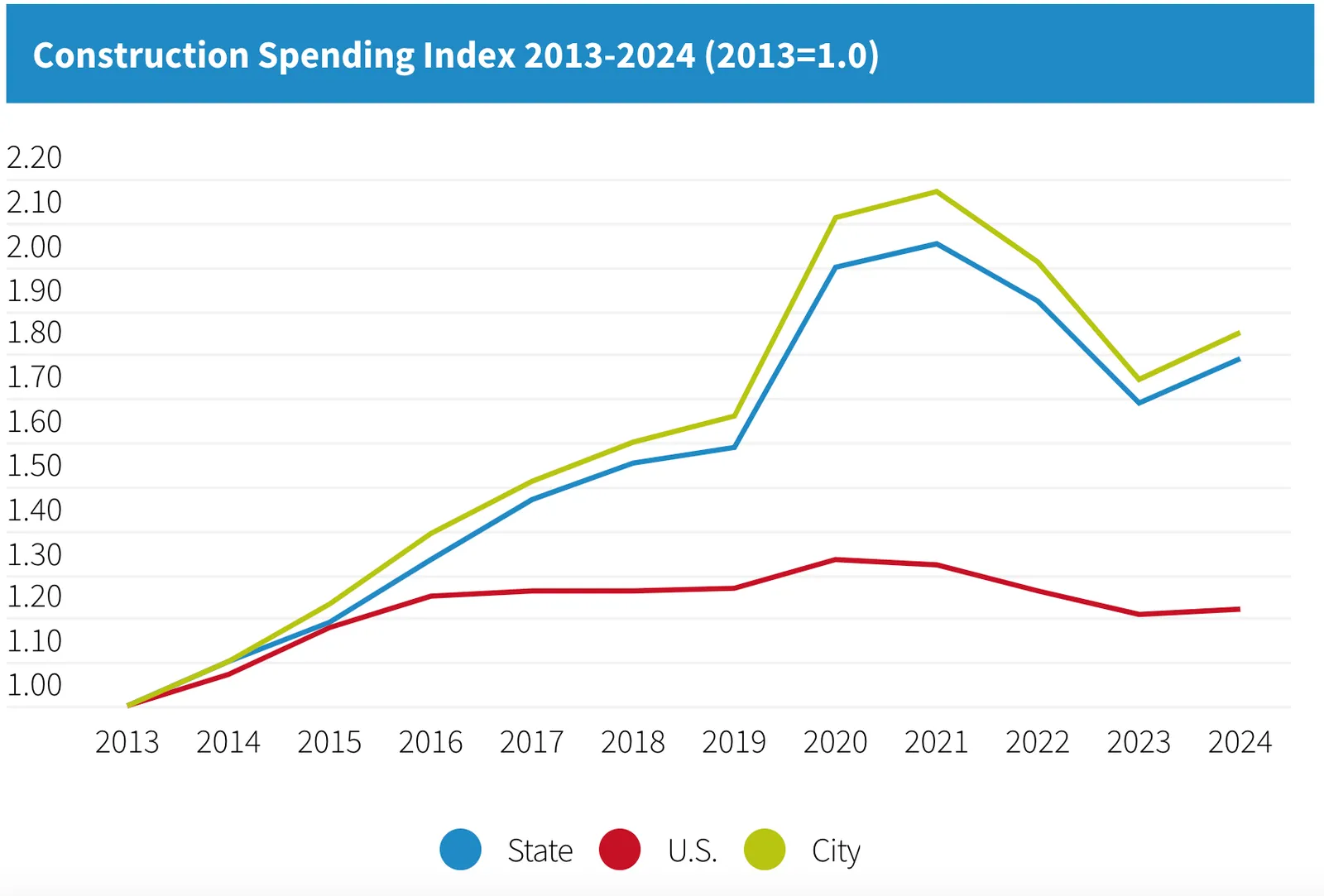

Phoenix and the rest of Arizona have outpaced the U.S. in construction spending compared to their 2013 amounts.

Herron said that the “big pressure” on contractors is coming from a lack of labor, with projects pulling workers from as far away as California. Other builders have struggled to find workers as a result of megaprojects, like TSMC’s current $12 billion semiconductor fab in Phoenix.

However, Bacon believes that area contractors are attractive employers for local trade professionals.

“Our edge here is, ‘Hey, you can be home every night and still build in Phoenix,’” Bacon said.

Going dry?

Another concern among builders and their clients is the availability of water — Arizona has struggled through historic droughts in recent history, some of which even led to stalled construction in parts of Phoenix, according to the Associated Press.

“There's been a great deal of people who have moved to Phoenix and the city has grown, and at the same time, you have a great deal of water-thirsty industries that have moved to Phoenix,” Herron said.

Projects like data centers and semiconductor fabs are seen as water-guzzlers, leaving some local residents concerned about future development. To counter these fears, Bacon said that Bechtel is working with clients to reduce how much water is used on projects, and he doesn’t think residents in the area should be worried about these projects threatening the supply.

“They should have very minimal concerns, even where water ends up being discharged. It goes back to the local infrastructure for various other uses. It’s not wasted,” Bacon said.

Even with the issues it faces, the Valley of the Sun’s construction market won’t be cooling anytime soon.

“Southern Arizona, the Phoenix area and beyond, will continue to be very competitive,” Bacon said.