Dive Brief:

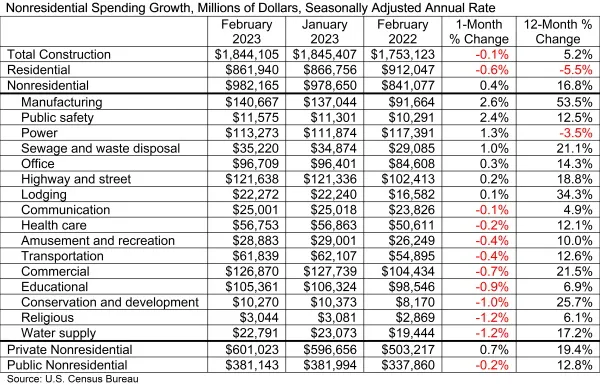

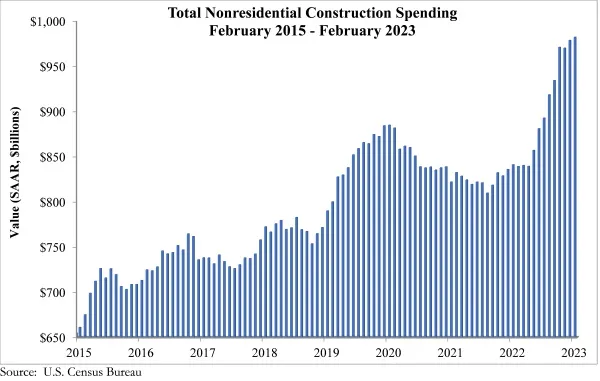

- National nonresidential construction spending increased 0.4% in February to a seasonally adjusted annualized basis of $982.2 billion, according to an Associated Builders and Contractors analysis released Monday.

- Manufacturing projects predominantly accounted for the increase; spending in the other 15 nonresidential segments collectively declined in February, according to Anirban Basu, ABC chief economist.

- “Nonresidential construction spending increased for the eighth time in the past nine months in February,” said Basu. “Importantly, almost all of the nonresidential sector’s momentum is attributable to manufacturing-related construction, which accounted for nearly 35% of the year-over-year growth in spending.”

Dive Insight:

From the wider perspective of total construction spending, which includes housing, expenditures decreased 0.1% in February due to declines in single-family building and public construction, according to a report from the Associated General Contractors of America released Monday.

The AGC also reported that spending on manufacturing construction shielded overall construction spending from a larger decline. Spending on manufacturing plants jumped 2.7% in February, according to the AGC report.

“Continued strong demand for manufacturing plants and data centers, along with an increase in power projects, contributed to the increase in private nonresidential construction,” said Ken Simonson, AGC chief economist. “Those segments appear likely to keep growing for many months to come.”

Private nonresidential spending inched up 0.7%, while public nonresidential construction spending decreased 0.2% in February, according to the ABC report.

Even though the outlook for manufacturing construction remains strong, concerns around financing could dampen spending in the other nonresidential sectors, said Basu.

“While the manufacturing segment should continue to see elevated levels of investment, tightening credit conditions will likely hinder nonresidential construction momentum in the near term,” said Basu. “Contractors maintain a health level of backlog… but a gloomy economic outlook and difficulty securing financing are potential headwinds for the industry for the rest of 2023.”

That uncertainty around construction financing is already bleeding into spending data.

For example, spending declined on a monthly basis in nine of the 16 nonresidential subcategories, according to the ABC report. Water supply spending decreased 1.2% in February, while commercial construction dropped 0.7%.

The largest public categories posted mixed results as well, according to AGC. For instance, highway and street construction spending ticked up 0.3%, while education construction fell 0.9%.