Since the COVID-19 pandemic began, multifamily developers and builders have had their work cut out for them as they try to budget for their lumber needs.

After months of wild fluctuations, lumber futures fell to their lowest level in a year earlier this month, according to lumber price data from NASDAQ. They have since reversed course, and currently stand at just under $600.

This drop followed two pandemic-era price bubbles in the market, where lumber futures rose to record highs in the thousands of dollars before dropping below $500.

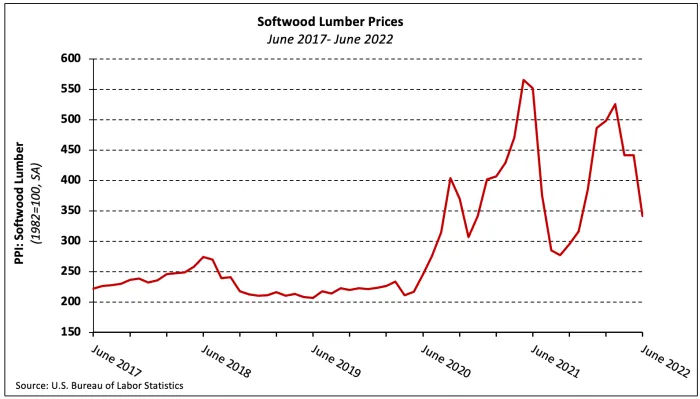

The producer price index for softwood lumber fell 22.6% in June 2022 alone, and 35.0% overall between March and July 2022, according to a report by senior NAHB economist David Logan.

In the entire history of the U.S. Bureau of Statistics’ softwood lumber producer price index, which goes back to 1947, prices never exhibited more than 10% volatility in a given month until early 2020, when the cost of lumber spiked 20%. Since then, the high ends of price volatility have ranged from 25%-30%.

NAHB economist David Logan told Multifamily Dive that this shift stems from the ongoing impact of the COVID-19 pandemic on the lumber industry, starting with sawmill closures in March and April 2020. “A good portion of those production cutbacks continued through July and August of 2020,” Logan said.

This coincided with a boom in housing demand — something the lumber industry did not anticipate, according to Logan. “They didn't want to be sitting on huge inventories of lumber, so that's what initially caused the large upswing in prices in 2020… Housing activity remained extremely robust [through 2021], but U.S. producers were putting out the same amount of output as they had been the prior year.”

The impact of inflation

At a time when the price of most materials has been rising, lumber costs have moved against the grain of inflation, according to the National Multifamily Housing Council’s Construction Quarterly Survey for the second quarter of 2022.

When asked about their approaches to mitigating price increases or potential supply shortages for lumber, very few Construction Quarterly Survey respondents made design changes or turned to alternative products, materials and suppliers. Almost half — 48% — had changed their purchasing and warehousing schedules as a buffer against future price shifts. Thirty-seven percent had taken no action at all, a jump up from 18% the previous quarter.

These depressed lumber prices — at least compared to the last two years — could stem from the impact of inflation on industries that depend on lumber, according to Paula Cino, vice president of construction, development and land use policy at NMHC.

“This could very well be part of the inflationary story,” Cino said. “As we see interest rates rise and costs go up, that is actually putting downward pressure on housing as well as other big purchases and renovation potential. So that is causing some of the volatility in the lumber space, even though we see prices escalating elsewhere.”

Despite the negative impacts of lumber price volatility, Cino observed that the multifamily construction space is strong, and that the NMHC remains optimistic despite an unknown future.

“The takeaway is that there's still uncertainty in the space, because we know that what our members can't do is go to an alternative,” Cino said. “...I think most observers would say that they're just continuing to expect the unexpected. And that's been the only consistency — that the uncertainty and volatility is probably something that is going to stick with us at least for the end of the year.