President Donald Trump’s recent firing of a Bureau of Labor Statistics commissioner over July’s federal jobs report cast nationwide attention on the practice of monthly revisions to the data.

Trump took issue with the Aug. 1 report’s revision of previous months’ numbers, which reduced the employment numbers from May and June. Nevertheless, revisions to federal data are common, according to construction economists.

The practice comes as the BLS collects new data from employers who may be slower to report previous numbers, or as it corrects any errors.

Ken Simonson, chief economist for the Associated General Contractors of America — who also served from 2009 to 2015 on BLS’ Data Users Advisory Committee — joined other economists in reinforcing the accuracy of the numbers, despite their negative reflection of the economy. He also warned that the Aug. 1 firing of BLS Commissioner Erika McEntarfer could weaken trust in national jobs data.

“It is extremely unfortunate that the president removed a distinguished career economist and cast aspersions on the report,” said Simonson. “It may backfire on him in that a subsequent report with more positive numbers will now be regarded as having been manipulated to please him.”

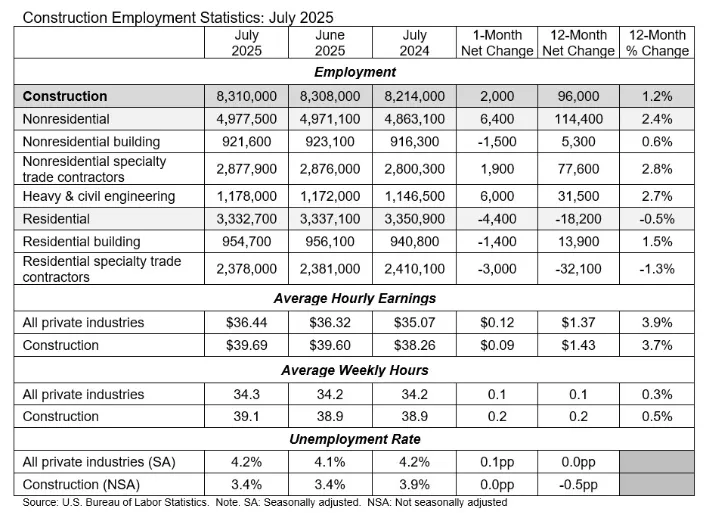

In terms of revisions to construction employment numbers, the BLS dropped June growth numbers by 90% from 147,000 new jobs to 14,000 new jobs, said Anirban Basu, chief economist of Associated Builders and Contractors. By comparison, for the year before June 2025 the average monthly revision between the first and second estimates was roughly 15,000 jobs, Basu said.

July numbers

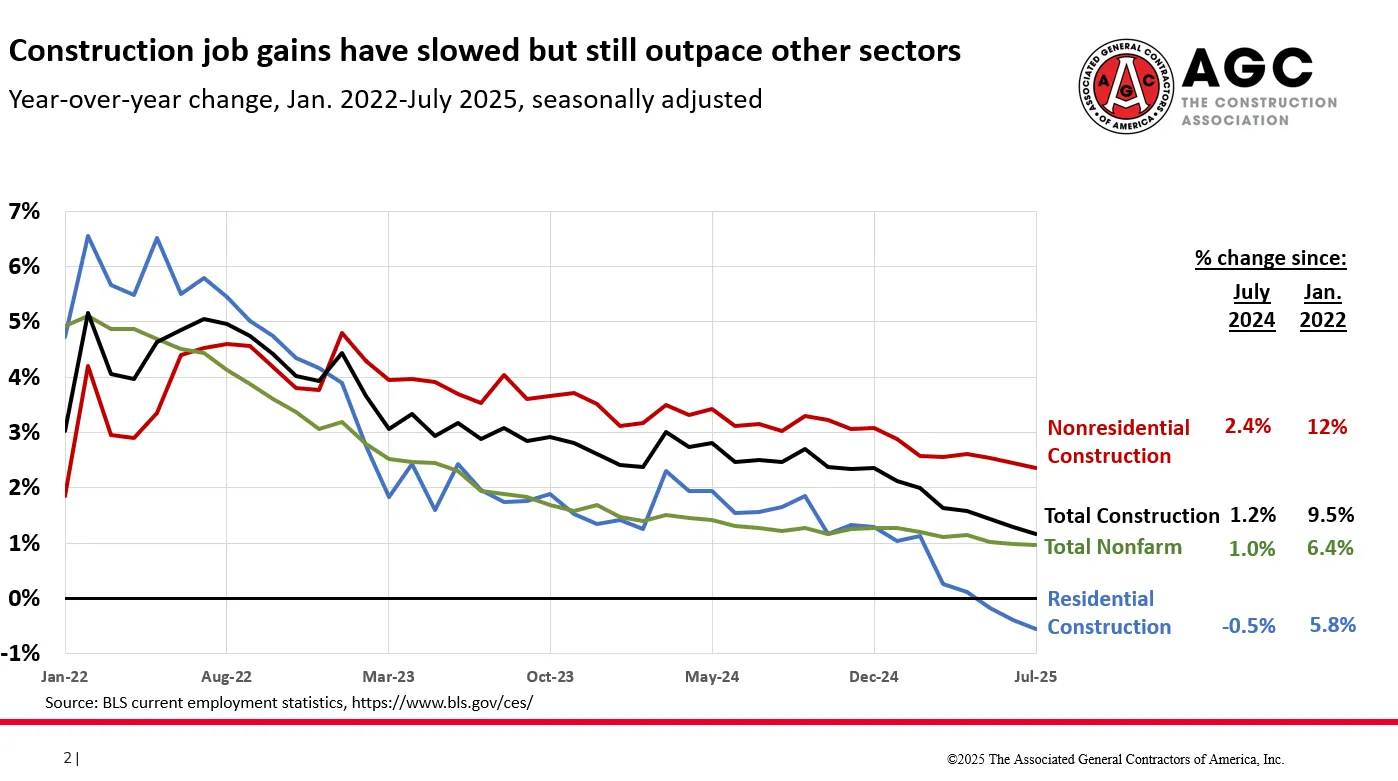

For the July construction employment numbers, which were released the same day as the May and June revisions, nonresidential building employment rose by 6,400 jobs compared to June, according to analysis by Basu. That mark was also higher year over year by 114,000.

Industrywide employment is up 1.2% over the past year, a pace Basu called “lackluster.”

“The volatility in official economic statistics merely adds to the most salient aspect of the economy today: pervasive uncertainty,” Basu told Construction Dive. Softening construction could be attributed to high interest rates, a slowing economy and that uncertainty, Basu said.

“In short, unless contractors are engaged in ongoing public works, data center and/or related power construction, the near-term outlook is not especially positive,” he said.

Residential construction has seen a continuous decline in employment numbers due to what Simonson called an “extreme weakness” in multifamily and single-family sectors.

For the time being, construction’s employment outpaces declines in overall, total nonfarm payroll numbers, BLS data shows. That may not last, however.

“I see no reason to expect positive figures or an extreme positive,” Simonson said about the near future. “I would expect construction employment to remain pretty close to current levels.”

Looking ahead, Basu cautioned that contractors may need to tighten the purse strings.

“That means perhaps spending less aggressively on equipment and adding personnel. It may also mean releasing underperformers from employment after a period of rapid industry hiring,” Basu said.