Contractors hoping for relief from the Federal Reserve will have to wait a while longer.

The central bank held its benchmark federal funds interest rate steady Wednesday afternoon in the range of 4.25% to 4.5%. The decision disappointed builders that had hoped for a jolt to jumpstart stalled projects.

The pause also keeps heat on Fed Chair Jerome Powell. President Donald Trump has repeatedly pressured Powell to cut rates and has even floated firing him. Legal experts say a president’s authority to do so is dubious, except for cause.

The administration has been trying to build a case for just such a cause, though, calling into question costs for the $2.5 billion renovation at the Fed’s headquarters, which Trump visited last week.

But after Wednesday’s decision, Trump — and general contractors rooting for a rate cut — will have to sit tight for now.

Private work stalling

Prolonged borrowing costs continue to weigh on developers reliant on traditional financing.

Many projects still depend on short-term floating debt, said Joe Biasi, head of commercial capital markets research at Newmark, a New York City-based commercial real estate advisory firm. That structure has become harder to justify as borrowing costs have remained elevated and lenders have grown more selective.

Yet not all sectors are slowing at the same pace.

“Markets that rely on more traditional financing will continue to be cautious or slower in 2026,” said Matt Murphy, core markets leader and leadership team member at DPR, a Redwood City, California-based general contractor. “But markets with large amounts of capital investment such as data centers and manufacturing are forecasted for continued fast-paced growth.”

That uneven environment has pushed contractors to lean harder on portfolio diversification. At Adolfson & Peterson, a Minneapolis-based general contractor, a blend of public and private work has helped soften the blow from weaker commercial activity.

“If interest rates remain unchanged going into 2026, we expect a mixed impact on our project pipeline,” said Granger Hassmann, regional president at Adolfson & Peterson. “Private sector work, especially in residential and commercial markets, will remain slow due to continued financing constraints.”

To keep projects on track in this environment, contractors say success depends on tighter preconstruction planning and flexible execution. These are essential for risk mitigation and ultimately maintaining momentum, said Robert Brown, CEO of GCM Contracting Solutions, a Fort Myers, Florida-based general contractor.

“Our ability to self-perform concrete and deliver projects under a design-build model gives us an edge when speed, cost control and schedule certainty matter most,” said Brown. “Those are critical differentiators in this environment.”

Brown added GCM is spending more time on feasibility studies, engineering support and front-end procurement.

“We’re seeing heightened scrutiny on financing and pro forma performance,” said Brown. “Clients [are] looking to preserve flexibility, whether that means phasing a project, streamlining specifications or delaying vertical construction.”

Hassman echoed that view. He said Adolfson & Peterson is pursuing early buyouts and using value management to keep projects viable. Collaborative contracting has also helped the firm protect budgets and avoid delays.

“We’re having proactive conversations with owners and developers about project timing, financing challenges and how to keep deals in place despite the market pressures,” said Hassmann. “Our goal is to stay ahead of any potential cost impacts and provide solutions that keep projects moving forward without compromising value or schedule.”

Shift to public work

With many privately financed projects hitting a wall, contractors are increasingly turning to public projects backed by federal infrastructure dollars and local bond measures, said Peter Dyga, president and CEO of Associated Builders and Contractors Florida East Coast Chapter. The result is a discernable shift in portfolio strategy.

“There’s been a noticeable pivot toward public and institutional work,” said Dyga. “Prolonged interest rates have made private capital more cautious, while public sector projects have offered more predictable timelines and financing.”

That shift doesn’t mean firms have abandoned private-sector work altogether. Many are simply leaning into segments still showing activity, such as data center and manufacturing construction, said Murphy.

“When some of our core markets are slower, others have ramped up dramatically,” said Murphy. “That allows us to shift focus to those and not pursue work outside of our normal scope.”

Fed still cautious

The Fed’s decision to hold rates reflects more than just macroeconomic caution. Powell has pointed to persistent inflation as justification for holding back on cuts.

The most recent June inflation data posted higher results than expected. The consumer price index increased at a 2.7% annual rate in June, above the Fed’s 2% inflation target.

“The why matters,” said Biasi. “If rates remain unchanged because of a reacceleration in inflation, that is a problem for construction activity.”

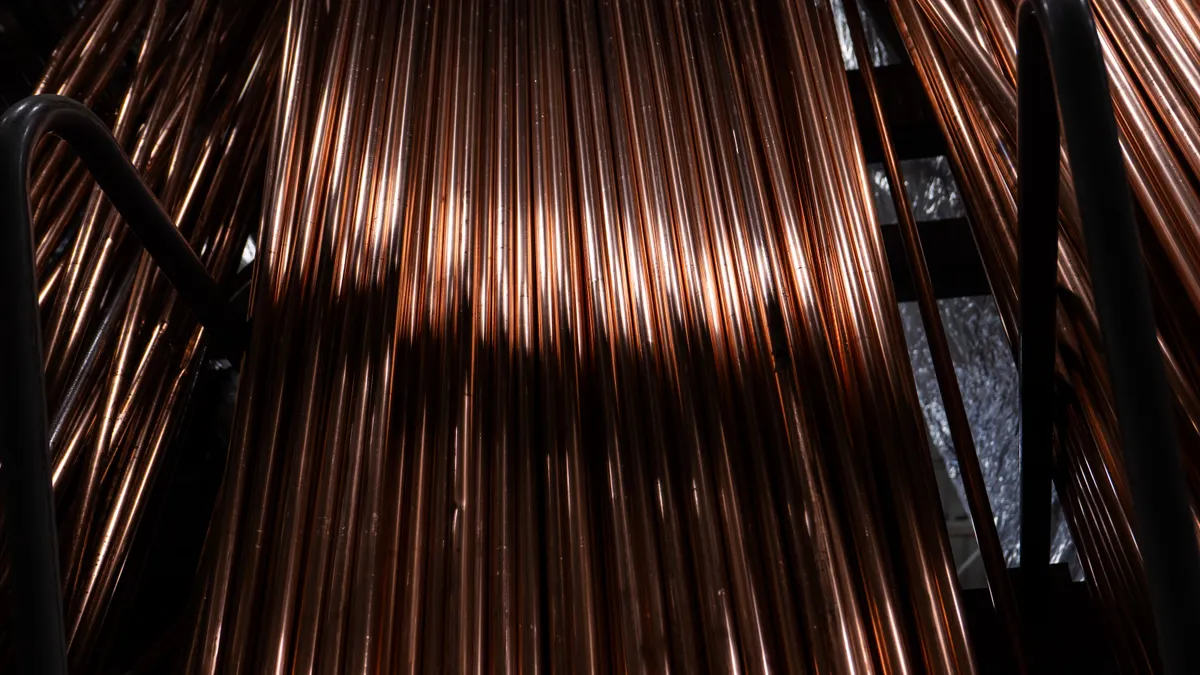

A Newmark-tracked basket of 21 common construction inputs rose 2.5% through the first half of 2025, nearly identical to midyear increases in 2024 and 2023. But some materials surged faster.

Copper wire and cable prices jumped 10.3% through June, following a 17.6% jump over the same period last year. Those pressures have made it more difficult to underwrite new construction, said Biasi.

“Construction is using short-term floating debt, so expectations of rate cuts can be helpful to getting construction going, and construction lending has picked up in the first half of 2025 when compared to 2024,” said Biasi. “However, higher interest rates reduce the amount of projects that can pencil.”

Projects that do move forward, he said, tend to be smaller or rely on less leverage.

Not everyone is waiting

Not all firms see interest rate movement as the defining factor in whether to move forward. Some developers say they have already priced in current conditions, and will be pressing ahead where fundamentals make sense.

“If the Federal Reserve holds rates steady, we do not expect a significant shift in our project pipeline,” said Patrick Chesser, president of the Southeast region at Ryan Cos., a Minneapolis-based construction firm. “Everyone borrowing capital would prefer a lower cost, but we are in a unique environment where cutting short-term rates could actually push the 10-year Treasury higher.”

The 10-year Treasury yield serves as a benchmark for long-term fixed-rate financing, so an unexpected spike could make permanent debt more expensive, even if the Fed cuts its policy rate. Chesser said Ryan Cos. updates its pro formas monthly based on yield curve data and avoids making bets on political cycles.

“We trust the Fed will continue to follow the data and remain focused on its dual mandate, rather than respond to political pressure,” said Chesser.

Even in higher-rate conditions, projects with pre-leasing, credit tenants or strong long-term outlooks still make sense. “A good deal remains a good deal, and we focus on projects we believe in and are confident we can close,” said Chesser. “Securing the right partner early in the process is essential.”

Outlook on future cuts this year

The Fed has not ruled out rate cuts later this year. But its latest decision, paired with ongoing inflation concerns, suggest change will come slowly.

In the meantime, contractors continue adapting with a focus on project fundamentals and long-term strategy.

“Many firms are prioritizing backlog quality over quantity,” said Dyga. “Higher interest rates have narrowed margins and led to more conservative go or no-go decisions.”

And even if rates fall, limits on labor could prevent a sudden wave of new construction.

“Lower interest rates may increase demand for projects,” said Murphy. “But the industry can only build as much as there is labor to do so.”