Construction planning momentum finished the year strong largely due to the strength of familiar drivers, including data centers, according to Dodge Construction Network.

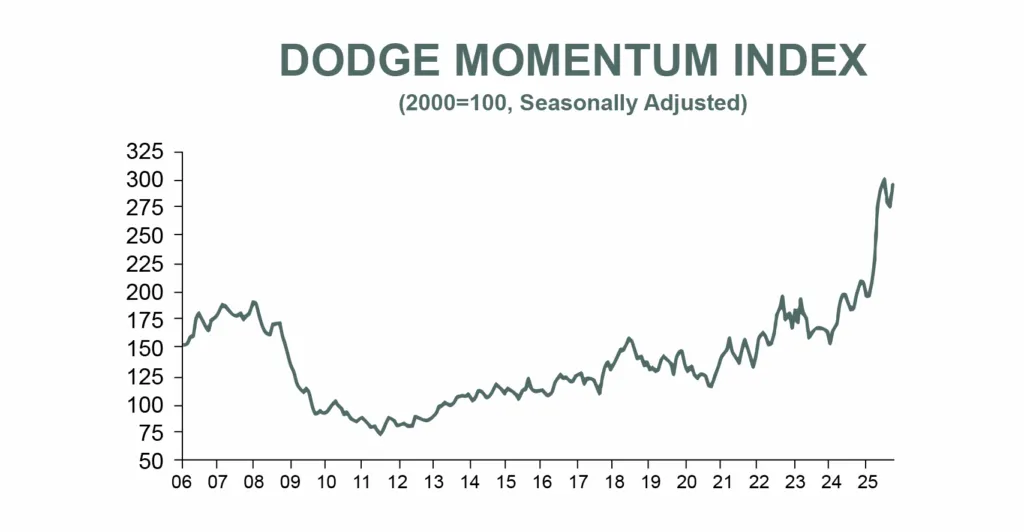

The Dodge Momentum Index, which tracks nonresidential construction projects entering the planning stages, jumped 7% in December. The figures lead actual construction spending by a full year, and show both commercial and institutional planning improvements, which were up month-over-month 3.5% and 14.9%, respectively, according to the report.

The move pushed the index to finish 2025 up 37% compared to 2024, with the commercial and institutional portions up 35% and 43%, respectively. Similar to previous reports, data center construction planning, as well as healthcare projects, largely accounted for that growth, said Sarah Martin, associate director of forecasting at Dodge Construction Network.

And more should be in the works for the year ahead.

“Nonresidential construction starts, excluding manufacturing and transportation, are projected to accelerate in 2027 alongside sustained planning momentum in data center, healthcare and recreational building construction throughout 2025,” Martin said in the release. “Inflationary pressures will further support nominal activity levels, even as economic risks remain elevated.”

Martin also noted that projects in the fourth quarter of 2025 began to move through the planning phases quicker than the third quarter. That gives a “modest boost to our near-term outlook,” she said.

On the commercial side, planning activity accelerated most strongly for warehouses, office buildings and data centers, according to Dodge. Institutional planning also showed growth, specifically within the education and recreational groups.

Compared to December 2024, the index grew 50%, with the commercial and institutional segments up 45% and 60%, respectively. Without the data center boom, commercial planning activity was still positive, albeit slightly less so, up 30% year-over-year, according to the report.

A total of 34 projects, each valued at $100 million or more, entered planning in December. Major commercial projects included:

- Four phases of the Google data center campus in Summit, Oklahoma, valued at $500 million each.

- Phases 2 and 3 of the Central Park Data Information Processing Center in Loxahatchee, Florida, valued at $473 million and $431 million, respectively.

The largest institutional projects to enter planning included:

- The $450 million Atrium Health Hospital in Fort Mill, South Carolina.

- The $295 million St. Joseph Hospital Tower in Stockton, California.

- The $182 million SunRay Casino and Park in Clovis, New Mexico.