Dive Brief:

- Construction input prices rose again in the second half of 2025, though some materials fared better than others, according to a webinar from construction cost tracking firm Gordian.

- The increases mark a change after nearly three years of relative stability following a pandemic-era surge in costs, and that trend could continue in 2026, according to Gordian.

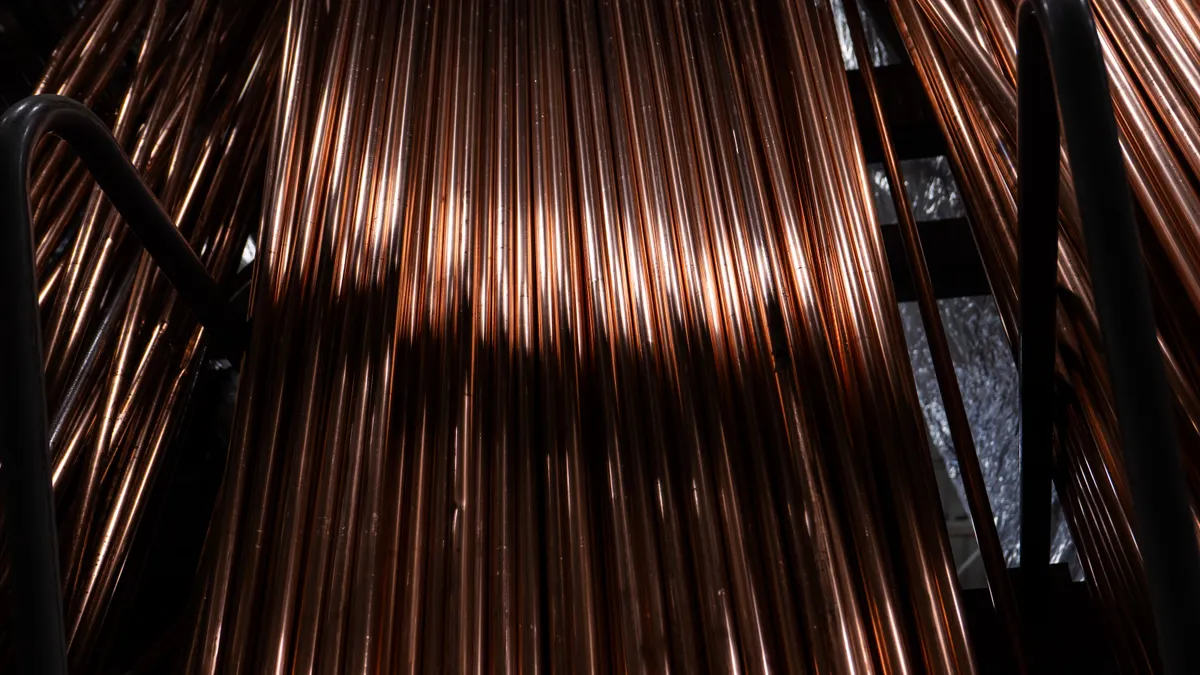

- Rather than labor costs, which jumped in nominal terms but lagged broader inflation, the increase in input costs stems primarily from materials. Inputs such as copper and electrical components, key to data center construction, posted the sharpest gains.

Dive Insight:

Contractors are bracing for a potential return of materials cost pressures in 2026.

Nonresidential input prices have jumped 44.5% since the onset of the pandemic in 2020, according to the latest Producer Price Index data. Most of those increases, however, occurred during the first two years. Since then, input price appreciation has largely stabilized.

“This material cost rally to back out 2025 was very real, and it was strong enough to pull the inflation adjusted historical cost index out of a multiyear decline,” Sam Giffin, principal product manager at Gordian, said during the webinar. “That’s unfortunate for many in the industry. Now, we’re again pushing our way back up.”

Copper and electrical components were the main accelerants in the end-of-year cost push. Those inputs play an outsized role in energy-intensive projects, including data centers, where demand is still booming despite an overall softening in the construction market.

“Copper is one of the few benchmark materials in which the cost borne by stakeholders in the construction industry are typically shaped by demand factors outside of it,” Giffin said. “We have continued electrification of equipment and facilities across the country, plus a huge surge in the growth of data centers and all the surrounding electrical grids. It’s bringing up a massive demand spike for copper.”

Analysts think those higher prices are likely to persist as supply-side constraints add to demand pressure. China, for example, consumes roughly half of the world’s copper supply, Giffin said. If that continues to weigh on the market while mining productivity struggles to keep pace, expect copper prices to continue their upward trajectory.

“Remember that it takes an average of 17 years for a new copper mine to go from discovery to active production,” Giffin said. “So, if that external demand doesn’t diminish and our productivity and supplies aren’t increasing any faster, copper prices are likely to continue climbing even higher than they are.”

Beyond raw copper, cost increases are spilling over into other electrical and mechanical components.

Giffin pointed to copper wire as one of the clearest examples. Long lead times for major equipment that has copper components, including transformers and chillers, have intensified price appreciation.

“There are other categories starting to show this pressure,” Giffin said. “They’re bucking the trend of previous years by increasing in price in the first quarter.”

Steel pricing, on the other hand, posted more of a “mixed bag,” Giffin added. That’s largely due to what analysts are referring to as “supply side discipline,” he said.

“With reduced demand and reduced import volumes, the market is stable,” Giffin said. “The lack of expansion might signal some stagnation on the horizon.”

Concrete and masonry, meanwhile, show a different pattern. Demand is constrained, but prices for certain inputs are sitting at their highest nominal levels since the highs of the pandemic.

“In categories like ready-mix concrete and concrete block, our prices are elevated relative to previous years,” Giffin said. “Given the trends in the market that are limiting demand for concrete cement, it seems likely that prices for these material categories are going to remain constrained for the better part of 2026.”