Dive Brief:

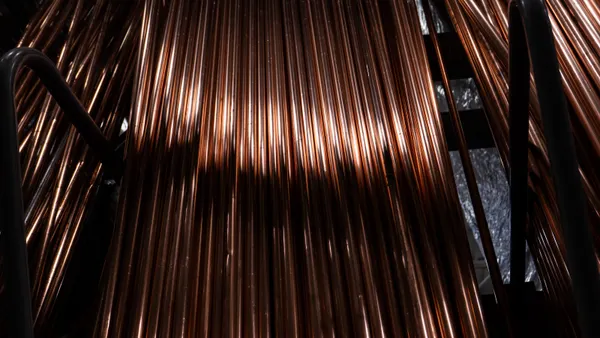

- Construction input prices increased 0.2% in May due to spikes in the cost of iron, steel, copper and aluminum, according to an analysis by Associated Builders and Contractors of U.S. Bureau of Labor Statistics data.

- Input prices are now 1.3% higher than a year ago overall, and 1.6% higher for nonresidential construction, with tariff-related price increases largely offsetting declines in energy costs. On an annualized basis, however, costs climbed 6% through May.

- The May figures do not reflect the latest round of steel and aluminum tariffs that took effect June 4, signaling even more cost pressure ahead on certain materials, according to construction economists.

Dive Insight:

Contractors are facing renewed cost pressures as prices for key materials surge under the weight of President Donald Trump’s tariffs.

Executives at a recent Skanska webinar said the new duties could add millions to project costs. That leaves contractors open to further cost spikes, said Simonson.

“The acceleration in the year-over-year rate of increase is alarming, given that most of the tariffs announced so far were not in effect when these prices were collected,” said Ken Simonson, chief economist at the Associated General Contractors of America, in a release shared with Construction Dive. “It is likely that contractors will be hit with substantial additional price increases shortly, unless the tariffs are postponed or rolled back.”

The pressure stems from products containing steel, which rose sharply even before the most recent round of tariffs. AGC officials noted domestic producers have already responded with new price increases, and warned that upcoming tariffs scheduled for July could further disrupt supply chains and inflate costs.

“Much of this growth was driven by rising costs for steel mill products and aluminum mill shapes, concrete pipe and fabricated structural metal,” said Macrina Wilkins, senior research analyst at AGC. “Contractors remain concerned that recently announced and upcoming tariff increases will drive material costs even higher, potentially leading to supply chain disruptions and higher overall project costs.”

Despite rising prices, many contractors still see positive trends in the months ahead, said Anirban Basu, ABC chief economist. For example, Basu said due to a “cooler-than-expected” inflation reading in May, the chances of an interest rate cut by the Federal Reserve in 2025 have improved. That would provide construction activity with a boost, he said.

But while expectations around profit margins and rate cuts may boost investor confidence, construction activity will likely remain sensitive in the near term to tariff decisions, said Michael O’Reilly, vice president at Rider Levett Bucknall, a New York City-based construction consultancy firm. Rate cuts would take some time to affect activity levels, and overall uncertainty still dominates the building landscape, he said.

“There is still a lot to shake out in terms of the implementation and effect of tariffs, and other policy changes,” said O’Reilly. “Our view is that continued investment into construction will remain cautious, for now.”