Dive Brief:

- Contractors are planning to invest in artificial intelligence but actual adoption rates don’t match those aspirations, according to a new report from the Royal Institution of Chartered Surveyors on AI in construction.

- Based in London, RICS used the survey responses of more than 2,200 professionals worldwide with 10% of respondents hailing from the Americas, according to the report.

- Approximately 45% of respondents reported no AI implementation in their organizations, with 34% in early pilot phases, according to the survey. In addition, only 1.5% of respondents reported AI use across multiple processes, while fully embedded, organization-wide AI use was reported by less than 1% of participants.

Dive Insight:

These intentions align with the AI arms race that larger contractors have engaged in in recent years. RICS’ report cites Burlingame, California-based investment firm Zacua Ventures’ Contech Investor Survey 2025, which revealed that 56% of polled investors were planning to put more funds toward AI compared to the previous year.

But that fervor hasn’t caught on for the majority of contractors, RICS’ report finds. In addition to the adoption gap, many companies are also still in the early planning stages for AI, if there’s planning at all. For example, 45% of respondents said their companies have limited capability and are only exploring how AI can be implemented. Nearly a third — 29% — said their organizations currently have no capability or plans in place.

That lack of actual implementation stands in stark contrast to the potential contractors see for AI in construction. At the same time, it underscores the industry’s reputation of being slow to adopt technology.

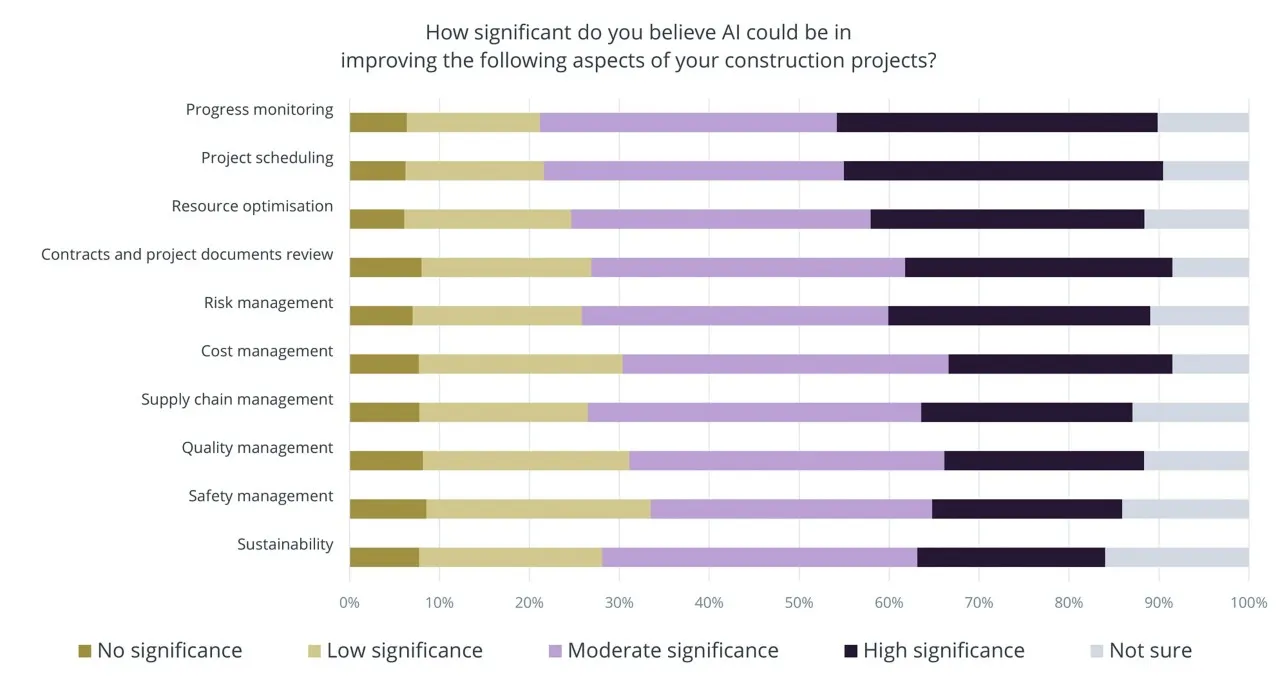

For example, RICS surveyed pros’ views on how significantly AI could improve various aspects of construction, including progress monitoring, safety management, sustainability and risk management. Most respondents rated AI’s significance as moderate to high, per the report. Respondents rated AI particularly high in areas already associated with data-rich processes and predictive decision making.

The survey comes at a time when contractors are feeling pressure to adopt technology or be left behind.

Contractors are also affected by adoption fatigue, according to Tanja Kufner, head of ventures and startups for the Nemetschek Group, a German software company geared toward construction.

“There's so many point solutions, so many workflows, and you have to do so many different logins. I just find that crazy,” Kufner told Construction Dive. “I've never seen that in any other industry.”

To address these challenges, RICS recommended a set of immediate-, medium- and long-term actions contractors can take.

In the immediate future, builders should upskill internal teams and establish cross-functional leadership groups to identify near-term AI use cases such as scheduling, cost estimating, sustainability and safety, according to RICS.

In the medium term, builders can then monitor and evaluate AI performance using benchmarks and user feedback. That will help make the case for scaling AI, while being mindful of the risks and environmental costs that come with the technology, per the report.

Contractors could then transition to the longer term implementation. That means scaling successful use cases across functions, projects or regions and engaging in collaborative standards development, per the report.

Despite lower implementation to date, the AI adoption curve could ramp up if builders develop these kinds of programs focused on the tech.

“These trends suggest the construction industry is reaching an AI tipping point,” the report concluded. “As supporting infrastructure develops, processes and practices become established and implementation costs reduce, widespread AI adoption could occur over a relatively short timescale.”