Dive Brief:

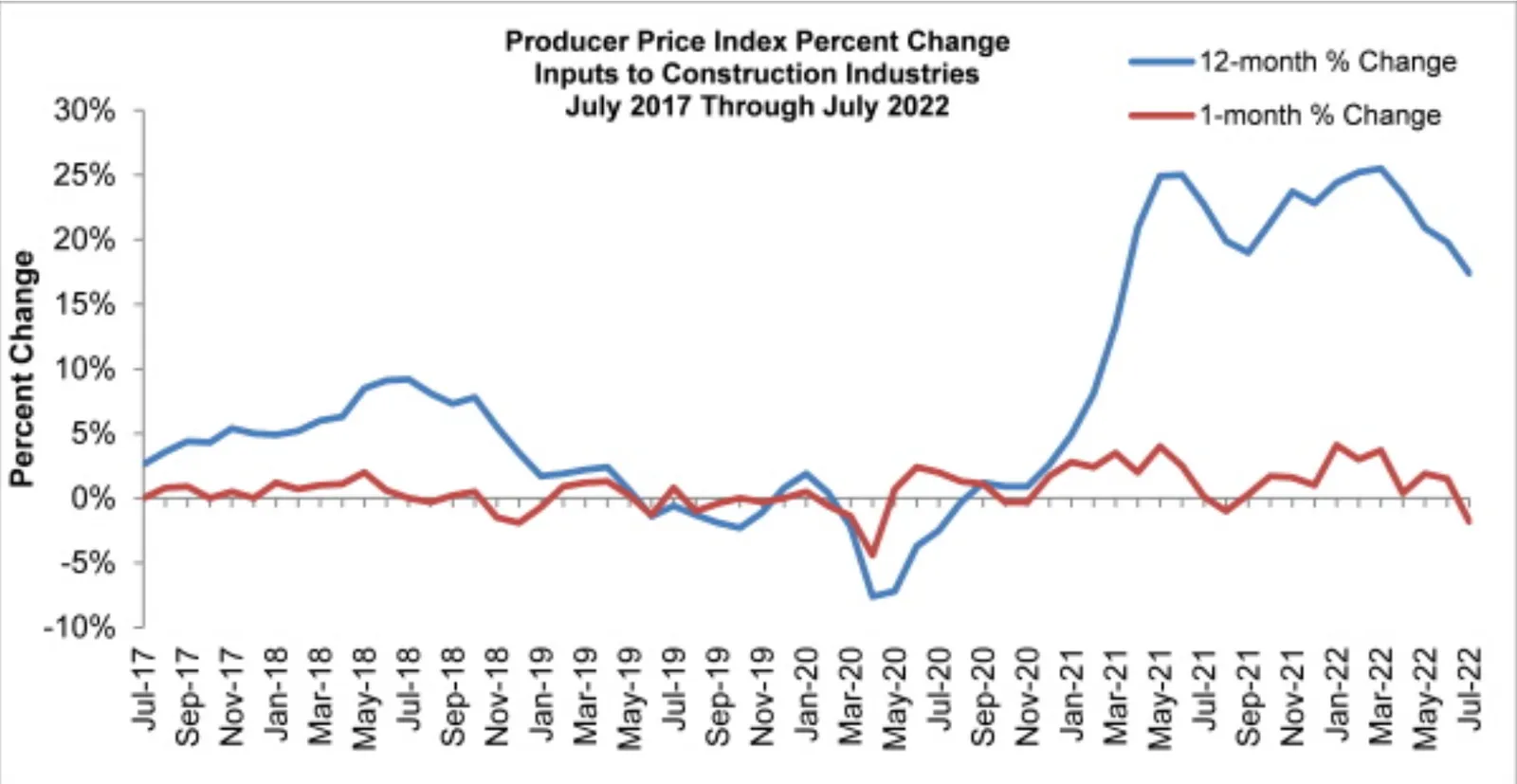

- Nonresidential construction input prices fell 1.8% in July, providing evidence that the worst of skyrocketing costs for building materials may be in the rearview mirror.

- An Associated Builders and Contractors’ analysis of the July producer price index, which measures the selling prices of goods and services, found input costs were down in eight of 11 subcategories for nonresidential construction, with a 27.6% reduction in natural gas costs leading the way.

- The news builds on positive momentum from June, when prices were still up, but a handful of categories showed signs of softening. “Today’s producer price index data supplies additional evidence that inflation has peaked,” said ABC Chief Economist Anirban Basu in a release on the numbers. “While the risk of recession remains elevated, recent government reports on consumer and producer prices make it more likely that the Federal Reserve will be able to engineer a soft landing or that any recession to come could be quite mild.”

Dive Insight:

After 20 months of sequential increases, July’s PPI was 0.5% lower than June, the first negative reading since April of 2020. Analysts had expected a further 0.2% increase, according to CNBC. Coupled with a lower than expected consumer price index report on Wednesday, the news buoyed stocks on Wall Street as investors awoke to the possibility that the Fed may raise interest rates less than initially anticipated in September.

In construction, the numbers don’t mean contractors are out of the woods yet. Input prices for nonresidential projects were still up 17.3% for the year, and a whopping 43.1% since the beginning of the pandemic, according to ABC.

Even as prices for iron and steel decreased 4.4% for the month, other basic materials continued to rise. Concrete, used in nearly every construction project, saw the biggest increase at 2.1% for the month. While natural gas had the biggest monthly decline, it was still up the most of any product for the year at 61.1%.

Producer Price Index, July 2022

| 1-Month change | 12-month change | |

|---|---|---|

| Inputs to nonresidential construction | -1.8% | -17.4% |

| Natural gas | -27.6% | 61.1% |

| Unprocessed energy materials | -21.2% | 47% |

| Crude Petroleum | -19.1% | 33.4% |

| Iron and steel | -4.4% | 2.8% |

| Steel mill products | -3.7% | 6.4% |

| Nonferrous wire and cable | -3.2% | 7.6% |

| Fabricated structural metal products | -0.8 | 21.3% |

| Prepared asphalt, tar roofing & siding | -0.4% | 18.8% |

| Softwood lumber | 0.8% | -7% |

| Plumbing fixtures and fittings | 0.8% | 11.4% |

| Concrete products | 2.1% | 14.4% |

SOURCE: Bureau of Labor Statistics, Associated Builders & Contractors

On balance, though, the decrease in prices was overwhelmingly positive. “A weakening global economy and ongoing supply chain adjustments have resulted in significant declines in the prices of a number of key commodities, ranging from oil to steel,” Basu said. “For contractors who have seen their profit margins diminished by elevated materials prices, a trend confirmed by ABC’s Construction Confidence Index, this is a welcome development.”