Editor’s note: To kick off 2023, Construction Dive is taking a look at the outlook for the country’s top construction verticals. This story is first in the series.

Manufacturing starts will be one of the few bright spots in 2023 in a shrinking commercial construction sector, according to Richard Branch, chief economist at Dodge Construction Network.

Total commercial starts are beginning to show strain as the economy slows, said Branch. Dodge expects starts on the commercial side, which includes retail, office, warehouse, manufacturing and hotel projects, to fall 13% in 2023 when adjusted for inflation.

“Commercial structures will feel recessionary in 2023,” said Branch. “But I think the really bad side here of commercial construction is really isolated,” particularly retail, traditional offices and hotel projects.

Below are the outlooks for several important sectors of commercial construction:

Retail projects show signs of deceleration

Retail construction starts have benefited from strong single-family residential growth over the past few years, said Branch. That is beginning to hit a turning point.

“There’s a strong relationship here between single-family and retail, it’s about a year lag between groundbreaking of single-family to groundbreaking of retail,” said Branch. “So, all those retail construction starts in 2019, 2020 and 2021 have been pushing retail construction higher [in 2022].”

Construction starts in the retail sector hit $19.4 billion in 2022, a 31% increase in nominal dollars from its 2021 level. But that will change in 2023, said Branch.

Dodge pegs construction starts in the retail sector to reach $20.2 billion in 2023, or a 4% increase in absolute dollars. However, when adjusted for inflation, the sector will shrink.

“As we move into 2023, if we think back to what’s happening in the residential sector in 2022 — single-family declining, multifamily will be declining next year — that’s going to [slow] retail construction starts,” said Branch. With inflation, "you’d be looking at a low-to-mid single-digit decline in retail,” said Branch.

Overbuilt warehouse sector set for peak declines

The warehouse sector is where the market will see more “significant declines in commercial construction starts,” said Branch.

The sector is coming off a record year in 2022, where starts totaled around $57.1 billion, a 19% jump from 2021. But Branch said 2022 was the sector’s peak.

That’s because Amazon, the largest player in warehouse construction, announced pullbacks in warehouse starts in the summer of 2022. The ecommerce giant accounted for about 16% of all warehouse construction starts over the past three years, according to Dodge.

In addition to a halt in warehouse construction, Amazon also announced last week plans to cut over 18,000 jobs.

For that reason, Dodge expects warehouse construction starts to drop 10% in 2023 to $51.3 billion.

Still, that activity level remains much higher than pre-pandemic levels.

“2018 and 2019 saw record levels of activity in the warehouse sector,” said Branch. “So, the one player stepping out of the market will see the levels come down, but overall, they should remain historically very high.”

Leisure travel picks up hotel construction

Hotel construction starts are beginning to mount a comeback from pandemic-induced lows, but the outlook remains mixed, said Branch.

On a nominal dollar basis, Dodge forecasts hotel construction starts to reach $12.2 billion in 2023, a 3% increase from 2022. That growth mostly centers on luxury, upscale properties.

“I don’t want to say that those kinds of properties are recession proof but if you’re going to identify anybody in that sector that’s recession proof, it would be those luxury upscale properties,” said Branch. “That should at least put a floor here on hotel construction in 2023.”

That bounceback is largely due to increased leisure travel, said Sarah Martin, senior economist at Dodge Construction Network. But starts in the sector still remain a fraction of what they were pre-pandemic.

“Note, the total dollar value of hotel starts in 2022 will remain more than 30% below the levels we saw in 2019, on a nominal dollar basis,” Martin told Construction Dive. “This market still has a long recovery ahead. On a constant dollar basis, hotels will mildly recede next year — in tandem with total commercial construction.”

Data centers carry office construction starts

Several factors continue to undermine office construction starts, such as tech slowdowns and remote work trends, according to Dodge.

“If we think about… how tight the labor market is, who has the power in this relationship?” asked Branch. “It’s clearly a seller’s market and more and more workers are demanding either hybrid or remote work in order to stay employed with the company and firms are clearly giving into that.”

Dodge forecasts office construction starts to total $48.8 billion in 2023, a drop of 1% from 2022. Branch added there is not “a lot of support for a strong buildout here over the next couple of years.”

Because the booming data center sector is included under the office umbrella, though, the numbers for pure office construction could be even worse.

“Data centers are incorporated in Dodge’s office category and have accounted for a weighty portion of the growth in the office sector this year,” said Martin. “We continue to expect weakness in traditional office projects over the next year, as remote and hybrid work continue to be prevalent.”

Demand for data center projects will remain strong over the next few years due to the “unwavering demand for data and cloud storage,” said Danny Horton, senior project manager of the data center division PCL Construction’s Seattle office. Branch also remains very bullish on data center construction growth in 2023.

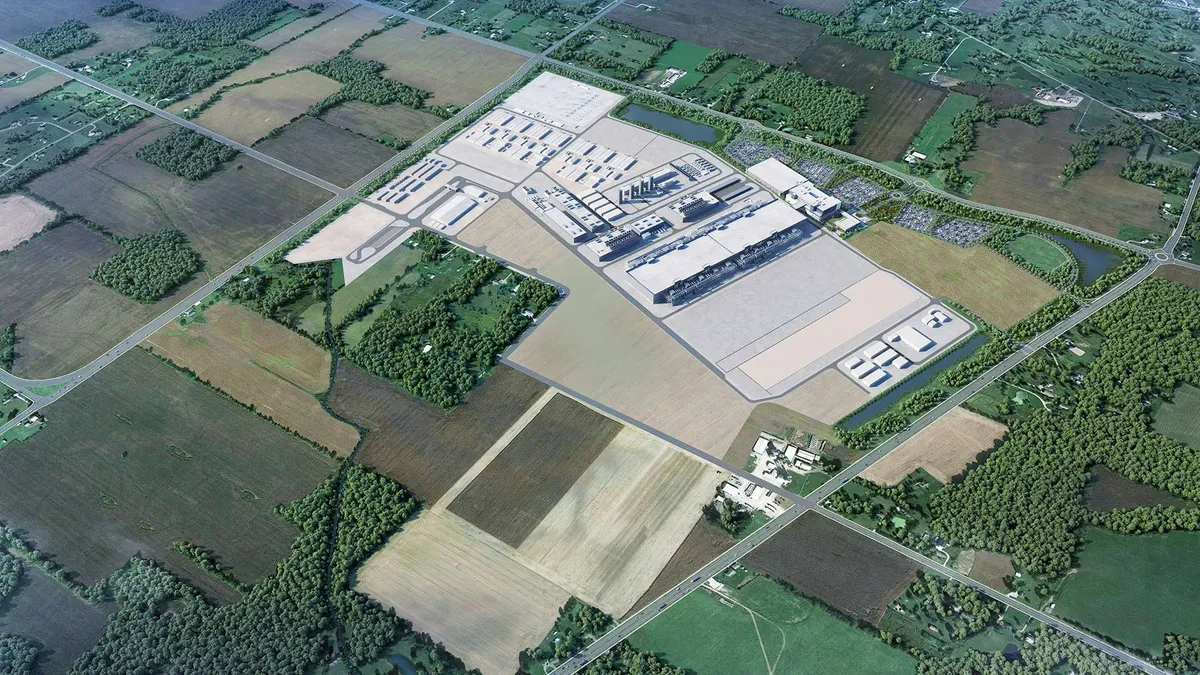

Manufacturing will hold up commercial construction

Manufacturing construction starts will remain a bright spot in commercial construction, said Branch.

Construction starts in the sector reached $89.4 billion in 2022, a 196% increase from 2021. Dodge expects that blistering pace to slow down in 2023 to about $51.2 billion, a 43% drop.

Still, that level would be a record for any year besides 2022 over the last three decades, according to Dodge.

That massive growth is due to the make-it-here onshoring push among American companies to build domestic chip fabrication factories and EV battery plants. The $52 billion CHIPS Act and the $485 billion Inflation Reduction Act will additionally continue to support abnormally high levels of activity in the coming years, according to Dodge.

“I do think this is a real game changer in terms of stabilizing the construction sector in 2023,” said Branch. “I would offer as well that I think that $51.2 billion is fairly conservative for next year. I wouldn’t be surprised if the upside here was closer to $60 billion.”