Dive Brief:

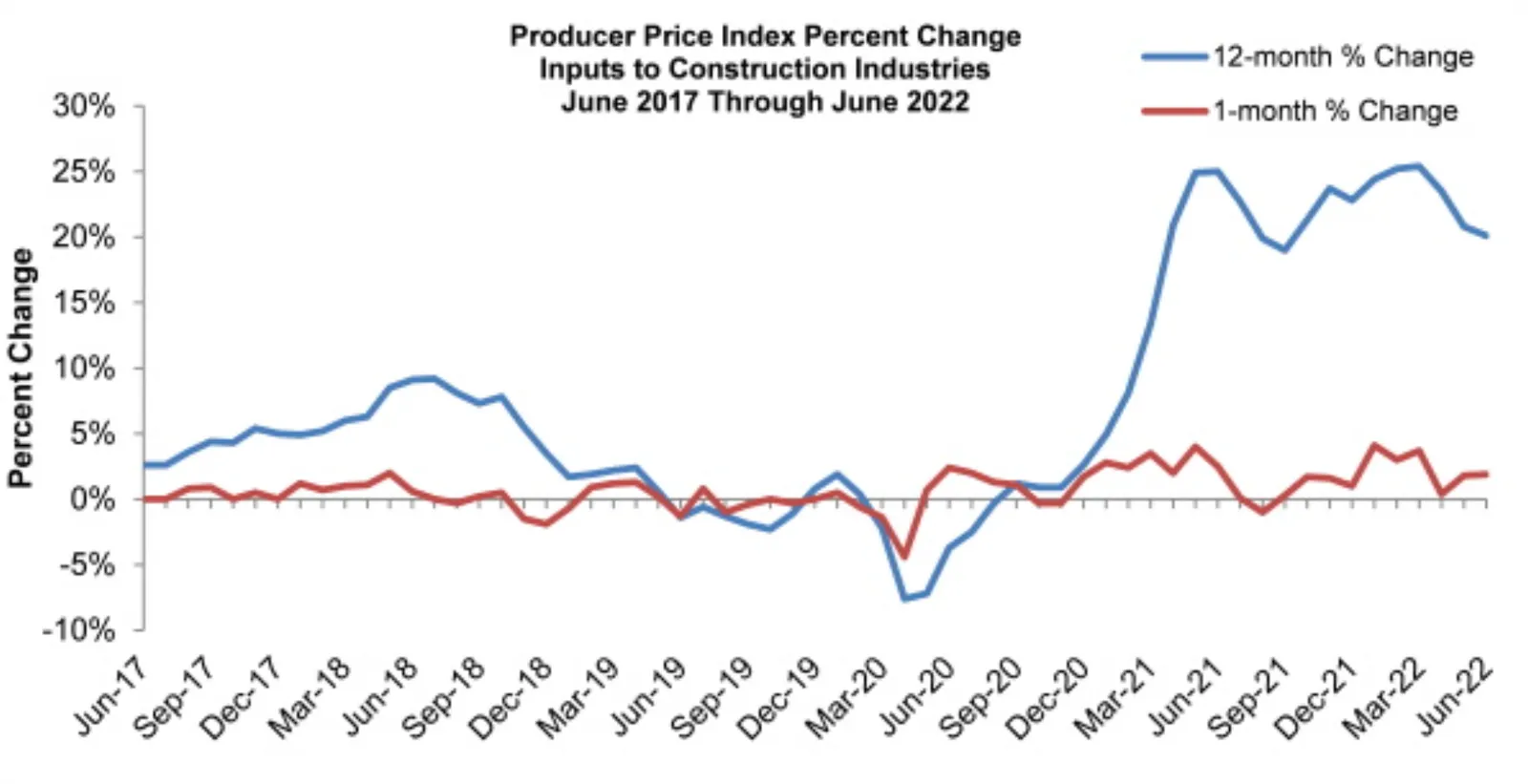

- Nonresidential construction materials costs climbed higher again in June, but there were signs of relief within the Bureau of Labor Statistics’ Producer Price Index report Thursday, as commodity values softened.

- Supplies for nonresidential contractors cost 1.8% more in June than a month before, and 20.3% more than a year ago, according to an analysis from Associated Builders and Contractors. But input prices were down in four of 11 subcategories, with softwood lumber falling the most, down 24.8% for the month.

- “It’s no secret that contractors and their customers have been walloped by massive increases in construction materials prices,” said ABC Chief Economist Anirban Basu in a statement. “But more recently, key commodity prices have declined, so it may be possible we have achieved peak inflation.”

Dive Insight:

The report comes on the heels of a broader analysis from Jay Pendergrass, director of supply chain at No. 11 contractor Gilbane, who noted declines in steel, copper and lumber going into the second half of 2022. Taken together, the optimism around pricing this week may signal the beginning of the end of pandemic-era material cost escalations for contractors.

Producer Price Index, June 2022

| 1-Month change | 12-month change | |

|---|---|---|

| Inputs to nonresidential construction | 1.8% | 20.3% |

| Softwood lumber | -24.8% | -38.1% |

| Iron and steel | -2.9% | 16.3% |

| Steel mill products | -1.8% | 22.4% |

| Nonferrous wire and cable | -0.6% | 15.1% |

| Plumbing fixtures and fittings | 0.4% | 11% |

| Fabricated structural metal products | 0.6% | 26.2% |

| Concrete products | 1.9% | 13.5% |

| Prepared asphalt, tar roofing & siding | 3.2% | 22.2% |

| Crude petroleum | 19.4% | 77.1% |

| Unprocessed energy materials | 20.4% | 126.8% |

| Natural gas | 24.3% | 224.5% |

SOURCE: Bureau of Labor Statistics, Associated Builders & Contractors

However, Basu’s interpretation of BLS’s numbers made it clear construction contractors aren’t in the clear. The war in Ukraine, combined with lingering supply chain issues, translate into ongoing risk when it comes to transporting any material goods around the globe.

And in his own analysis of the PPI numbers, Associated General Contractors of America Chief Economist Ken Simonson said the reported cost declines may not reflect the latest movement in the market.

“Some materials prices have fallen recently, but others appear headed for further increases,” Simonson said in a release. “Since these prices were collected, producers of gypsum, concrete, and other products have announced or implemented new increases. In addition, the supply chain remains fragile and persistent difficulties filling job openings mean construction costs are likely to remain elevated despite declines in some prices.”

But from Basu’s perspective, the specter of recession that has hung over the market in recent months may very well result in the relief of lower costs going forward.

“With much of the world at risk of recession, there is likely to be further downward pressure on commodity prices going forward,” said Basu. He added that while oil had previously cost $120 a barrel, this morning’s price had dipped into the low $90s, with natural gas prices also in decline. That may reflect a possible readjustment to disruptions caused by the war.

“We appear to be entering a new phase in input price trajectory,” Basu said.